One might expect there to be only the slightest similarity between venture capital and social investment; perhaps the fact that money changes hands or that a return is expected. Surely that is where the similarities end? Based on our experience, no it isn’t. We believe there could be a parallel to be drawn between grant-funding and investment in the development of fast-growth, high-potential organisations in the social and private sectors. Eh! – how so?

One might expect there to be only the slightest similarity between venture capital and social investment; perhaps the fact that money changes hands or that a return is expected. Surely that is where the similarities end? Based on our experience, no it isn’t. We believe there could be a parallel to be drawn between grant-funding and investment in the development of fast-growth, high-potential organisations in the social and private sectors. Eh! – how so?

Most VCs will point to five main areas of focus for a potential investment:

- · The people and management team;

- · The offering and market;

- · Potential for fast growth;

- · Support required; and

- · The finance itself.

The first three require due diligence of a level of detail and exactitude that would startle the average businessman; the last two require specialists, connections and, of course, the access to finance. We can cavil over these broad areas but our experience with successful social investments has yielded an interesting parallel.

The only difference between these areas and what VPF looks for is that VPF’s due diligence, when searching for fast growth social entrepreneurs, tends to be done initially for grant applications, not finance. Effectively then, this due diligence is supplemented by two to three years of in depth grant and pro bono assistance, which by definition creates an unmatched knowledge of the organisation’s capability - only then is social investment contemplated.

Because VPF actively looks for social entrepreneurs, a high proportion of grant recipients prove they are strong candidates for investment finance (typically generating a revenue stream supplementing charitable income very quickly). In fact VPF’s social investments have yielded a minimum 20% return on investment over 5 years with no losses (to date!). This is admittedly paltry by comparison with expectations of a high risk investment such as those made by the VC community, but it is not to be sniffed at in the social investment world.

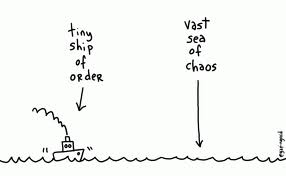

Fast growing charities and social enterprises suffer cash flow difficulties in the same way as any fast growth entity. There is much ‘chat’ about different financial support for the social sector, much of which seems to be no more than standard financial obfuscation (arguing about terms, whether something is or isn’t a social investment etc.).

Whilst clearly not applicable to the financial needs of a large stable charity, in this area of smaller, fast-moving organisations, there are two simple take-aways:

- Grant funding in early stage charitable social enterprises equals angel investment in early stage start-ups. In the first, VPF (and other grantors) get in-depth knowledge and access to management, reporting and, by extension further investment opportunities. In the latter, the angel investor gets, hmm, the same.

- Social investment (at least in the areas VPF specialises in) is the equivalent of a second stage VC investment – the model is proven, the organisation is understood and the right people are in place. The only difference is the rate of return.

So what I hear you grumble?

This has ramifications for finance organisations looking to invest in the social sector. It suggests that it makes sense to create a grant-making arm alongside an investment arm not only to help unearth those organisations at an early stage (good) but also to increase the rate of return of future investments (better).

This improves the availability of suitable investments whilst simultaneously improving the reputation of social investment as a valid part of an investment portfolio.

So no, not a license to lose but certainly food for thought if you are serious about social investment actually delivering a return and not just being philanthropy by another name.